Energy recovery transforms senior affordable housing

This case study was chosen as part of the Empire Building Challenge competition. Click here to learn more about the Empire Building Challenge competition.

Tags

The existing building participating in the Empire Building Challenge is George T. Douris Tower located at 27-40 Hoyt Avenue South in Astoria, NY and is a 167,582 square foot, 15-story, senior living apartment building built in 2009.

The goals of the retrofit project are to:

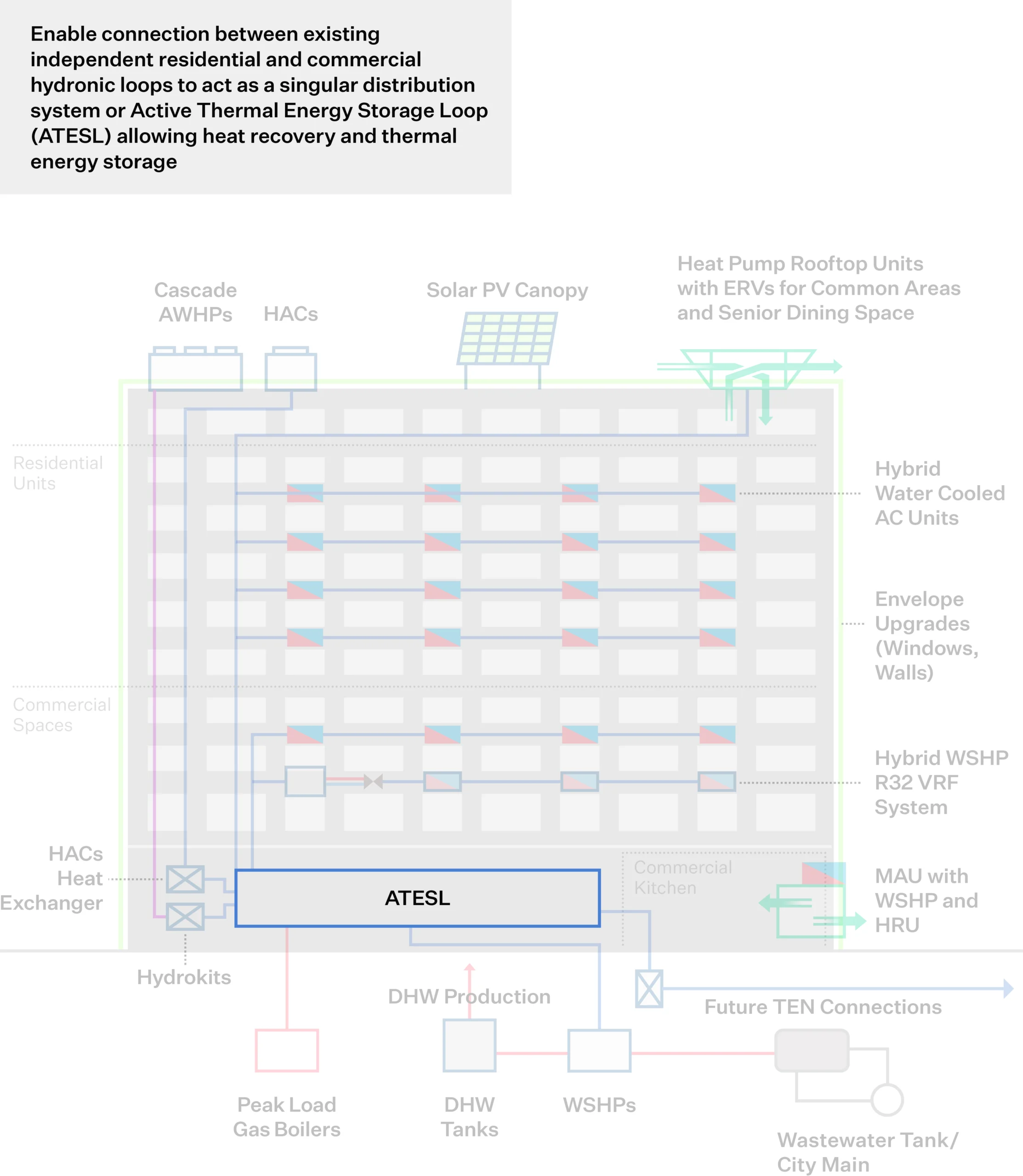

- Connect the commercial and residential heating, cooling, and domestic hot water thermal energy zones together to enable hydronic-based thermal heat recovery

- Replace existing residential and commercial terminal units to enable low-temperature hydronic heating and improve, or maintain, cooling services

- Recover energy for, and electrify, loads currently served by fossil fuels (heating and domestic hot water).

- Reduce construction costs by avoiding the staggering of measure implementation

- wherever possible.

- Minimize negative impacts on operating costs while making substantial carbon emissions reductions.

HANAC was founded in 1972 and is a citywide social service organization, servicing 30,000 NYC residents annually receiving funding from City, State and Federal agencies and has a portfolio of 650 senior affordable housing units throughout Queens, NY. HANAC’s mission is: to develop, implement and administer the operation of service programs for the betterment of the community; to provide these services to any and all who are in need without discrimination as to race, creed, national origin, or other defining characteristic; to work closely with other providers, the city, state, and federal governments for the betterment of the community.

Project Highlights

Step 1

Step 1: Examine Current Conditions

A baseline assessment is key to understanding current systems and performance, then identifying conditions, requirements or events that will trigger a decarbonization effort. The assessment looks across technical systems, asset strategy and sectoral factors.

Building System Conditions

- Equipment nearing end-of-life

- New heat source potential

- Comfort improvements

- Indoor air quality improvements

- Facade maintenance

- Efficiency improvements

Asset Conditions

- Recapitalization

- Capital event cycles

- Owner sustainability goals

Market Conditions

- Market supply changes

The building’s main HVAC equipment is still in place from the original construction and is nearing the end of useful life. This aligns with the 15-year recapitalization cycle for affordable housing which the building is undergoing in parallel with the decarbonization plan. Without this alignment, the building may have struggled to complete the remaining measures by 2035. The project will improve the quality of life for residents by increasing their ability to control space temperatures throughout the year, improving indoor air quality, and reducing the amount of noise heard from outside the building.

Step 2

Step 2: Design Resource Efficient Solutions

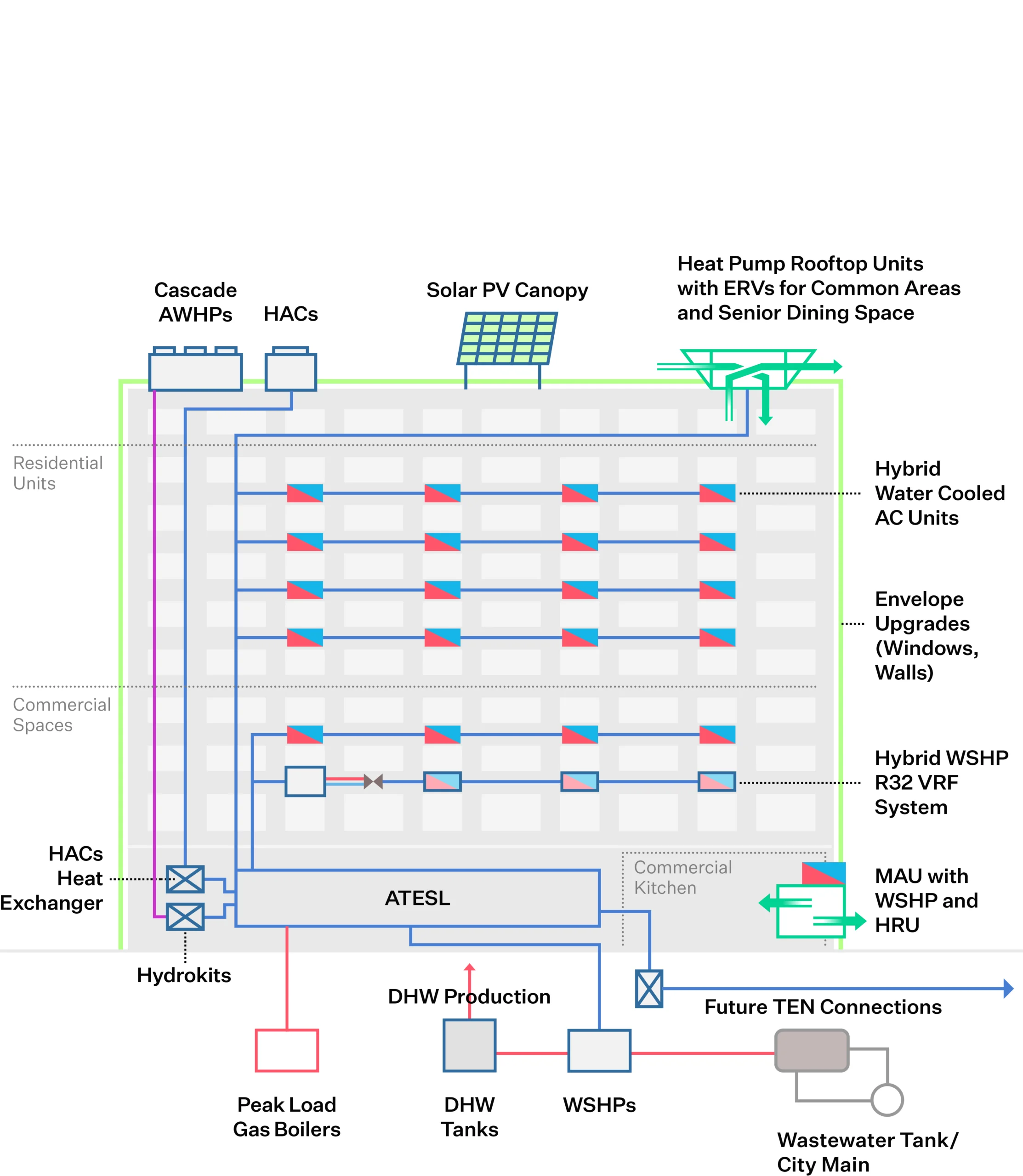

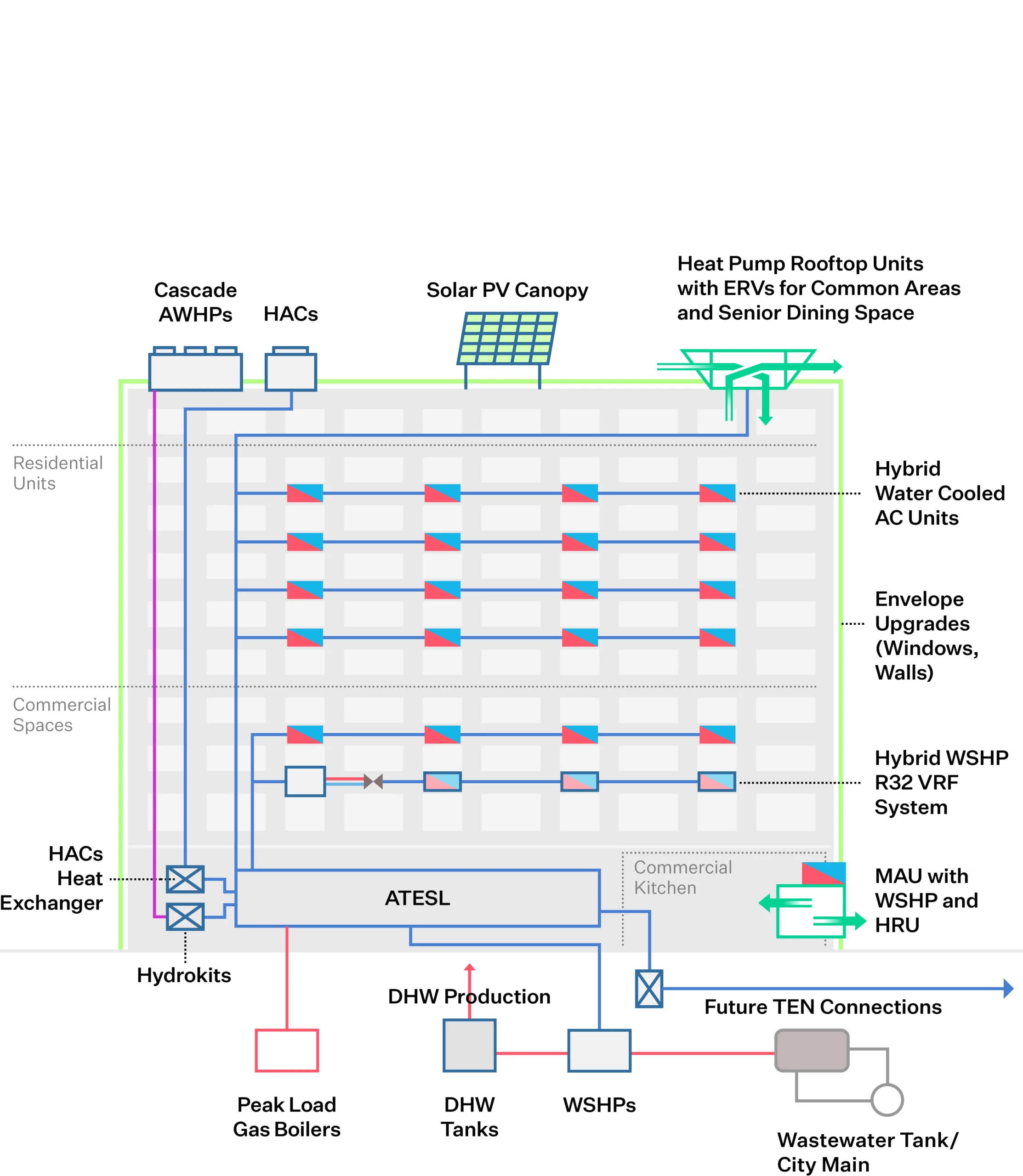

Effective engineering integrates measures for reducing energy load, recovering wasted heat, and moving towards partial or full electrification. This increases operational efficiencies, optimizes energy peaks, and avoids oversized heating systems, thus alleviating space constraints and minimizing the cost of retrofits to decarbonize the building over time.

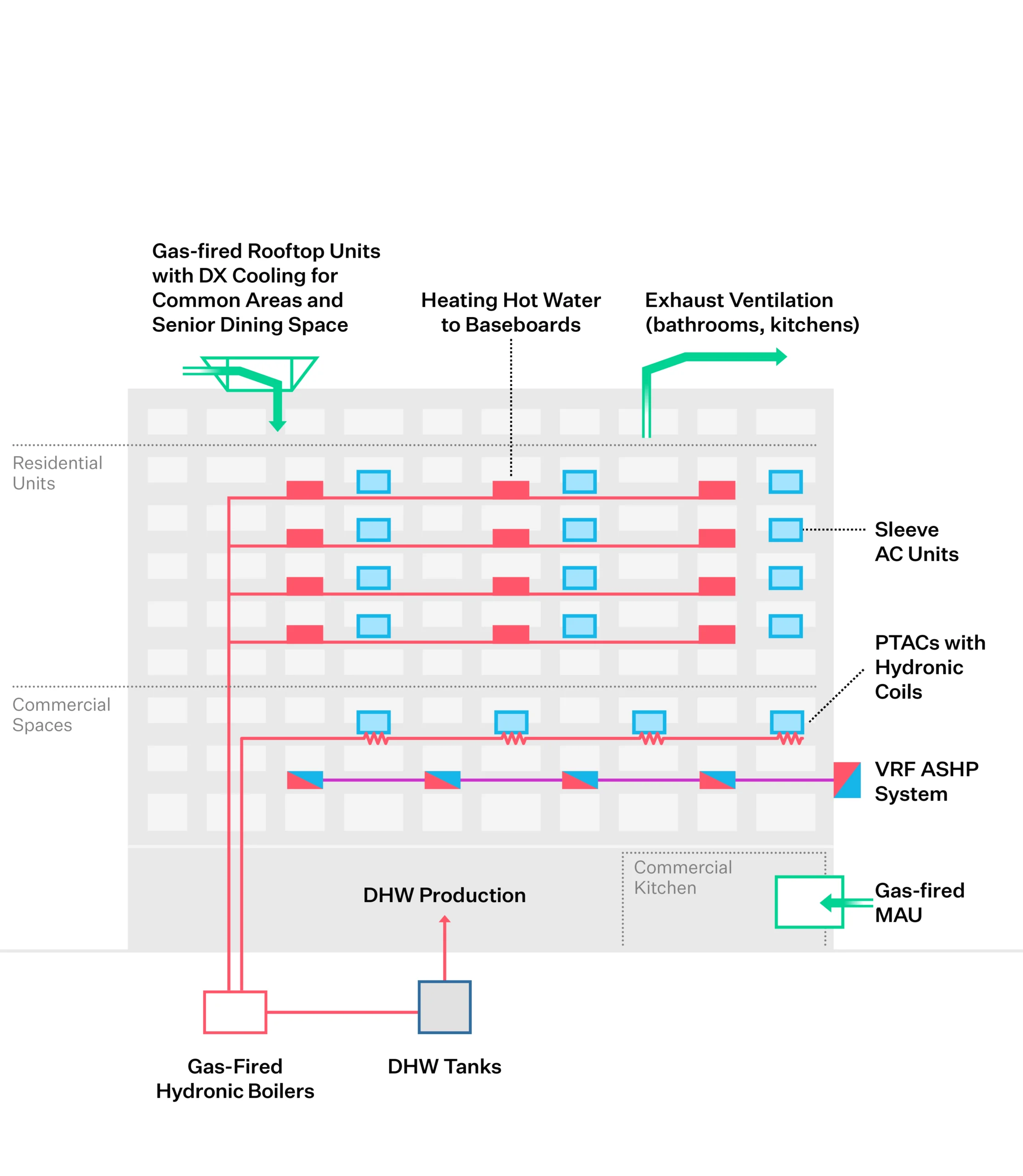

Existing Conditions

This diagram illustrates the building prior to the initiation of Strategic Decarbonization planning by the owners and their teams.

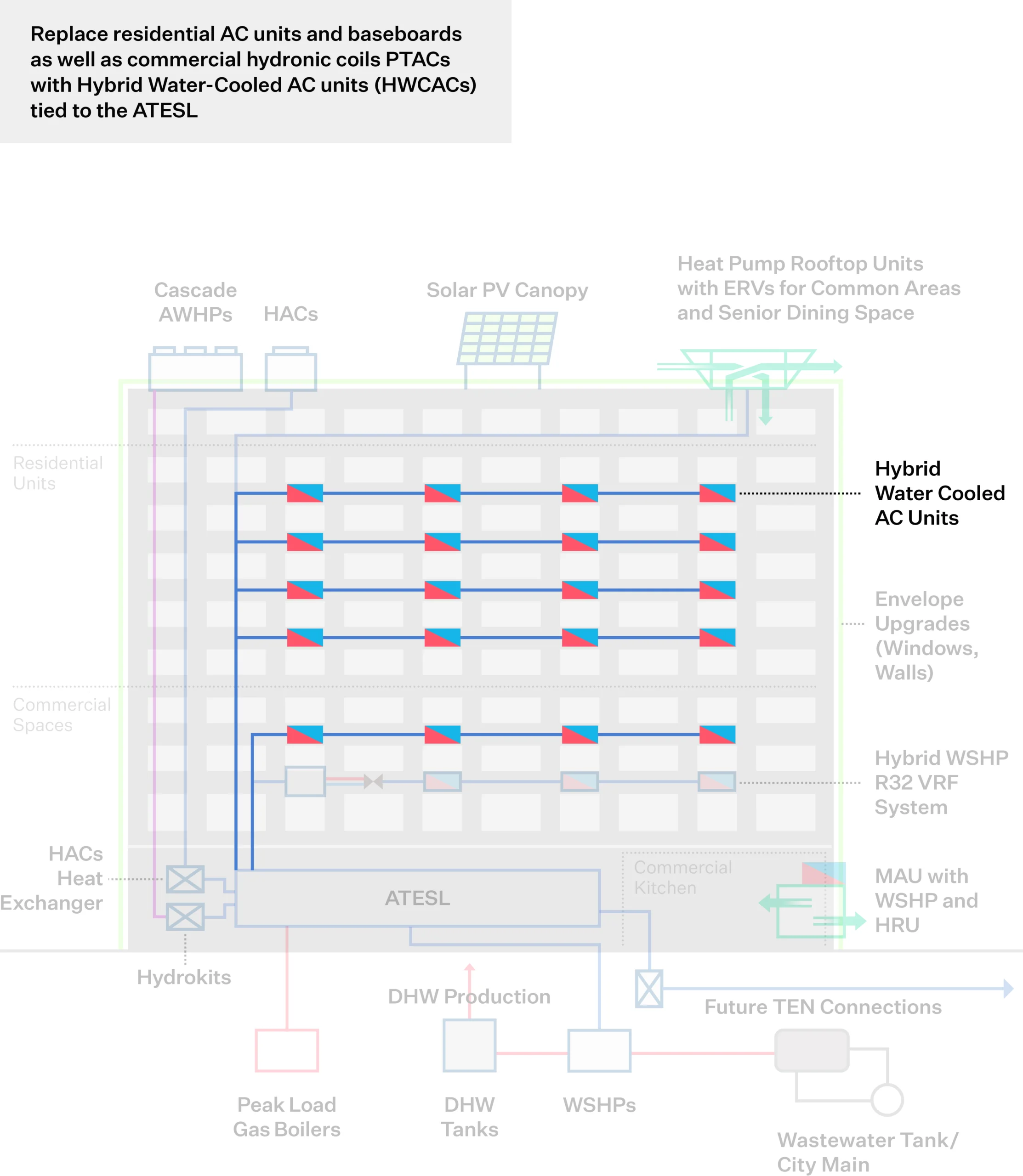

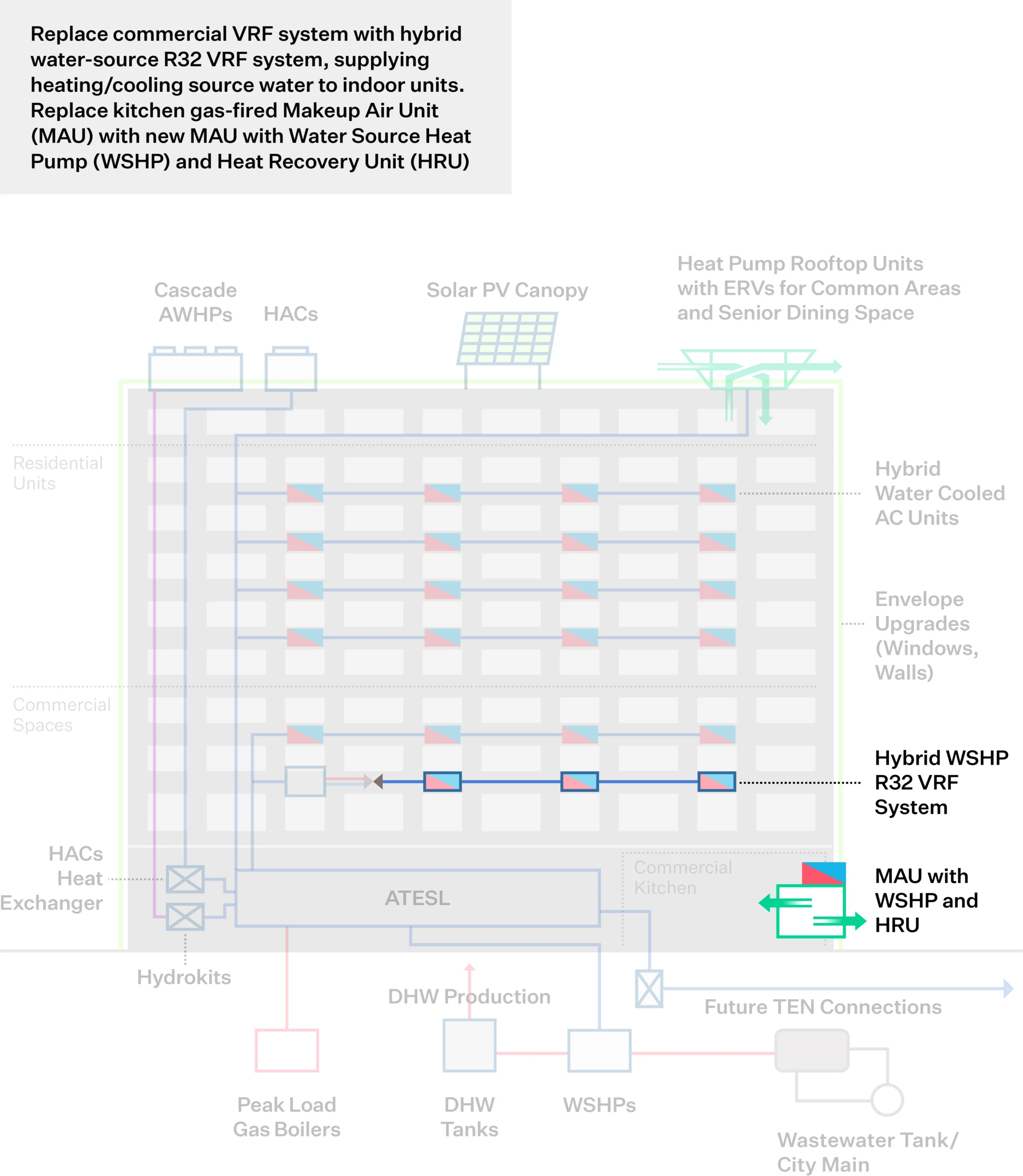

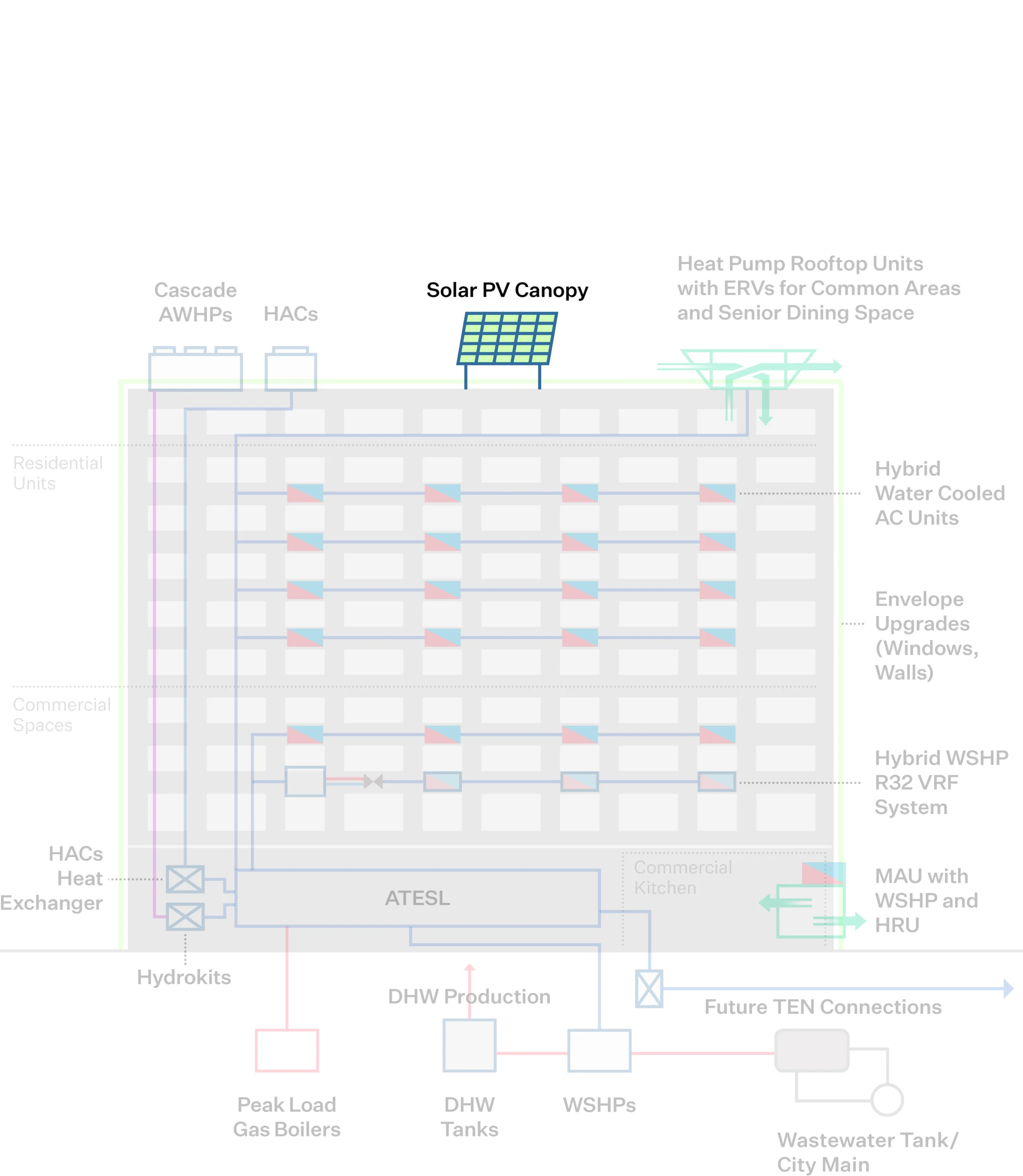

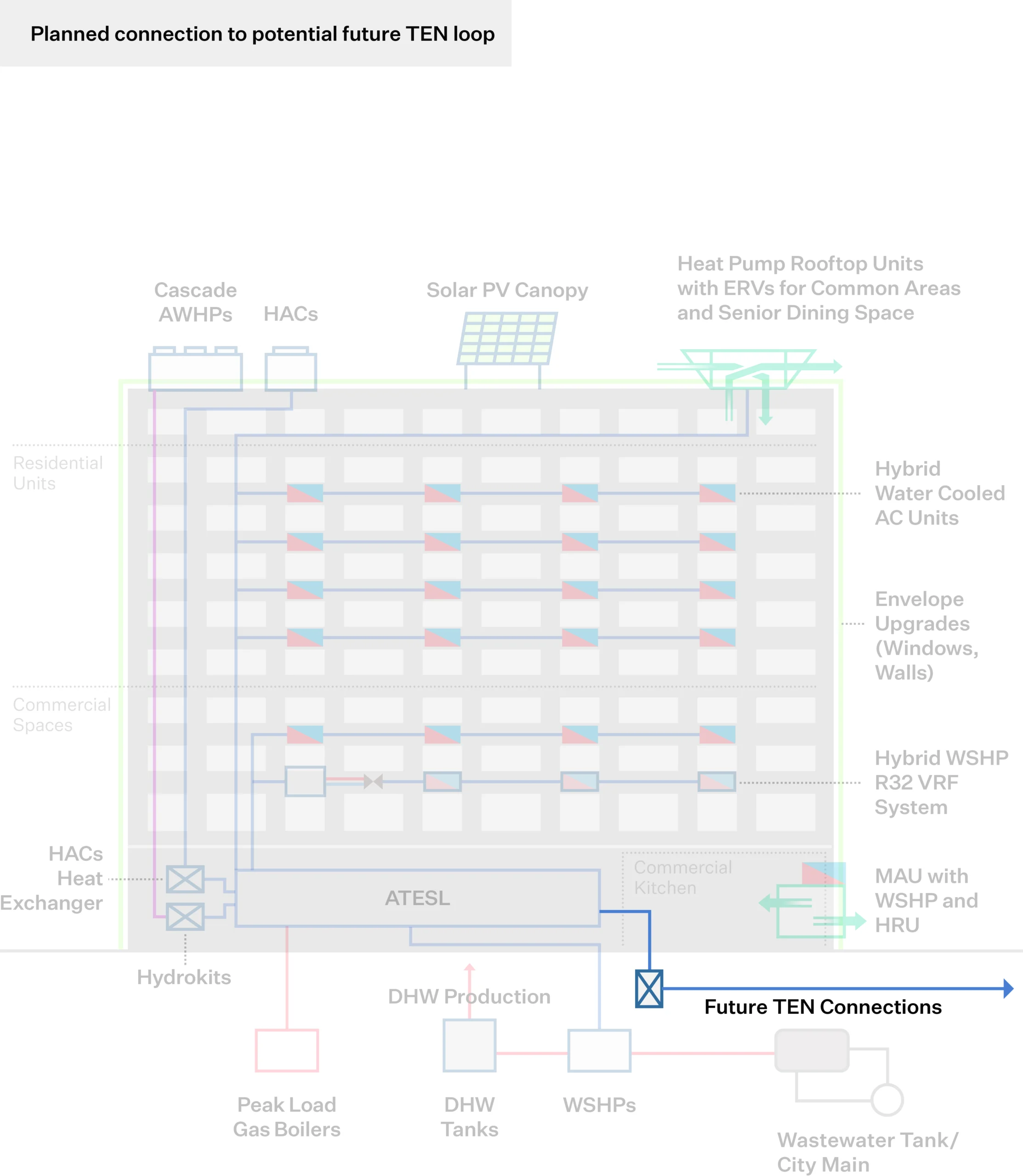

Click through the measures under “Building After” to understand the components of the building’s energy transition.

Sequence of Measures

2027

Building System Affected

- heating

- cooling

- ventilation

Step 3

Step 3: Build the Business Case

Making a business case for strategic decarbonization requires thinking beyond a traditional energy audit approach or simple payback analysis. It assesses business-as-usual costs and risks against the costs and added value of phased decarbonization investments in the long-term.

Strategic Decarbonization Action Plan

An emissions decarbonization roadmap helps building owners visualize their future emissions reductions by outlining the CO2 reductions from selected energy conservation measures. This roadmap is designed with a phased approach, considering a 20- or 30-year timeline, and incorporates the evolving benefits of grid decarbonization, ensuring a comprehensive view of long-term environmental impact.

The decarbonization roadmap underwent significant evolution throughout its development. Initially, plans centered on a geothermal system installed in the building’s parking area. This approach was extensively discussed during the design charrette, but the project team ultimately encountered two main issues with this approach that caused them to re-think the approach:

- Drilling in the garage space would have been very disruptive to the residents and the space is currently leased to a third-party to operate the parking garage. Any type of activity in this space would have caused lease issues and delayed, or potentially cancelled, the project.

- The cost of the geothermal equipment was not commensurate with the carbon and operating cost reductions that were expected.

After discussions with NYSERDA and other stakeholders, the team pivoted to a displacement approach using technology that, while having a lower COP, had a lower initial cost and would provide carbon reductions on a similar order of magnitude compared to geothermal.

The window and envelope measures were prioritized as part of the initial decarbonization phase to capitalize on construction coordination and to take advantage of the building’s recapitalization cycle. If this had not been done, it is likely that the measures would not have been installed until the next recapitalization cycle which might not have occurred until 2040.